Blogs

“Third-Party Posts”

The following link/content may include information and statistical data obtained from and/or prepared by third party sources that Financial Solutions, deems reliable but in no way does Financial Solutions guarantee its accuracy or completeness. Financial Solutions had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Financial Solutions. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Financial Solutions, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

Safe Money Options Heading Into 2026

A Financial Advisor’s Guide to Protecting What You’ve Worked So Hard to Build When markets are choppy and headlines are loud, many people start asking the same...

Retirement Income Planning Going Into 2026: Turning Your Savings Into a Lifetime Paycheck

For most people, retirement isn’t about a specific age or account balance—it’s about confidence.Confidence that the bills will be paid, that you can handle surprises,...

Estate Planning & You: Getting Ready for 2026 (Without Freaking Out)

state planning sounds like something for billionaires in marble mansions… not for regular people with a mortgage, a 401(k), a dog, and a favorite taco spot. But here’s...

Retirement Planning in 2026: How to Prepare for a New Era of Retirement

If you feel like retirement has gotten more complicated, you’re not imagining things. Between market volatility, rising costs, new tax rules, and longer life...

Retirement Planning in 2026: A Practical Playbook (and How Annuities Can Help)

TL;DR: Going into 2026, retirees face two big realities: markets that still swing and a shifting tax landscape. Focus on dependable income, flexible tax buckets, and a...

Retirement Planning Heading Into 2026: 7 Smart Moves For Clients Right Now

As 2025 winds down, retirement planning is shifting under three big spotlights: taxes in 2026, retirement plan rule updates, and Medicare drug-cost changes. Here’s a...

Why Life Insurance Belongs in Your Retirement Plan

Quick Take Life insurance isn’t just for parents with mortgages. The right policy can: protect a spouse’s income plan if one Social Security check disappears create...

Annuities 101: Why They’re (Sometimes) a Great Idea for Retirement

Quick Take Annuities are insurance contracts that can turn a portion of your savings into guaranteed income you can’t outlive. For the right person, they lower stress,...

Retirement Income Planning: A Practical Guide for Turning Savings Into a Sustainable Paycheck

Key Takeaways (TL;DR) Retirement success is less about “the number” and more about cash-flow durability, tax efficiency, and risk control. A resilient plan blends...

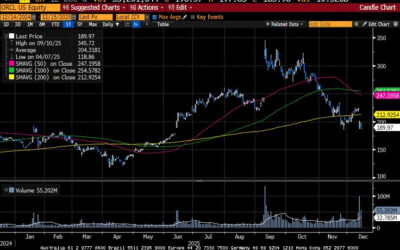

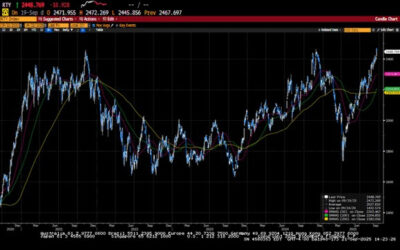

Weekly Market Commentary

The Federal Reserve, as expected, cut its monetary policy rate by twenty-five basis points to 3.50%-3.75% and tempered expectations for further cuts in 2026. The...

Weekly Market Commentary

Apprehensive investors pushed markets higher this week, with the small-cap Russell 2000 hitting a new all-time high, while the S&P 500 closed just 50 points below...

Weekly Market Commentary

The holiday-shortened week saw global financial markets trade higher. Increased optimism for a December rate cut, along with some constructive news on the AI front,...

Weekly Market Commentary

Financial markets continued to decline as investors sold AI-related stocks amid valuation concerns, while rotating into more defensive sectors such as healthcare and...

Weekly Market Commentary

Markets were choppy and ended the week with mixed results. Investors poured into risk assets on the idea that the longest US government shutdown was over, but a more...

Weekly Market Commentary

Well, the market finally had a significant pullback, but not before the S&P 500 and NASDAQ were able to set another all-time high. The week began with a deal...

Weekly Market Commentary

Investors sent US markets to another set of all-time highs despite concerns about an extended government shutdown. The U.S. government shutdown was largely dismissed...

Weekly Market Commentary

The S&P 500 hit a 28th record high for the year before settling lower for the week. Investors endured a choppy week of trading as better-than-expected economic data...

Weekly Market Commentary

The major US equity market indices forged another set of all-time highs as investors went all in on risk assets after the Federal Reserve announced a twenty-five basis...

Ed Slott’s Elite IRA Advisor Group (Ed Slott Group) is a membership organization owned by Ed Slott and Company, LLC. Logos and/or trademarks are property of their respective owners and no endorsement of (Taylor Fialkowski) or (Financial Solutions) is stated or implied. Ed Slott Group and Ed Slott and Company, LLC are not affiliated with Financial Solutions.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

SIMPLE Plan Contributions and Qualified Charitable Distributions: Today’s Slott Report Mailbag

By Andy Ives, CFP®, AIF® IRA Analyst QUESTION: Hello, I am searching for confirmation that Roth SIMPLE IRA contributions are not limited by modified adjusted gross...

Making Sense of the Roth 401(k)-to-Roth IRA Rollover Rules

By Ian Berger, JD IRA Analyst One of the most common retirement account transactions – rolling over Roth 401(k) funds to Roth IRAs – is also one of the most complicated...

How Your RMD Statement Can Help You

Sarah Brenner, JD Director of Retirement Education The rules for required minimum distributions (RMDs) can be complicated and, under the law, the responsibility...

Taxes on Required Minimum Distributions and Qualified Charitable Distributions from Trusts: Today’s Slott Report Mailbag

Ian Berger, JD IRA Analyst Question: Does a non-spouse eligible designated beneficiary (EDB) have to pay taxes on required minimum distributions (RMDs) either at...

2026: Here We Go Again!

By Andy Ives, CFP®, AIF® IRA Analyst It’s a new year, and the slate is wiped clean. Here we go again! While we are only one week into 2026, there are some important IRA...

Coming Soon: The Thrift Savings Plan Will Start Offering In-Plan Roth Conversions

By Ian Berger, JD IRA Analyst Since 2010, participants in certain private sector 401(k) plans have been able to boost their Roth retirement savings by doing an “in-plan...

Best of the 2025 Slott Report

By Sarah Brenner, JD Director of Retirement Education ‘Tis the season for lists! Best TV shows, best of music and best podcasts. The lists go on and on. In the spirit...

Grinch Gifts: Penalties and Missed Opportunities

By Andy Ives, CFP®, AIF® IRA Analyst The Grinch likes it when things go horribly wrong. He likes it when rambunctious pets tip over Christmas trees. He likes it...

Holiday Cheers and Jeers

By Ian Berger, JD IRA Analyst In the spirit of the holiday season, here’s a list of cheers and jeers for the IRS and Congress: Cheers to the IRS: To its credit,...

The following link/content may include information and statistical data obtained from and/or prepared by thirdparty sources that Financial Solutions, deems reliable but in no way does Financial Solutions guarantee its accuracy or completeness. Financial Solutions had no involvement in the creation of the content and did not make any revisions to such content. All such third-party information and statistical data contained herein is subject to change without notice and may not reflect the view or opinions of Financial Solutions. Nothing herein constitutes investment, legal or tax advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of Financial Solutions, execution of required documentation, and receipt of required disclosures. All investments involve risk and past performance is no guarantee of future results.

For the detailed requirements of Ed Slott’s Elite IRA Advisor Group, please visit: https://www.irahelp.com/

Medicare Advantage Heading Into 2026: What You Need to Know Before You Enroll

If you’re approaching 65, already on Medicare, or helping a loved one evaluate coverage, you’ve probably noticed something: Medicare Advantage plans are everywhere. And there’s a reason for that. More than half of all people on Medicare now choose a Medicare Advantage...

Medicare Supplement Plans (Medigap) for 2025–2026

What to Know About Filling the Gaps in Original Medicare If you’re approaching Medicare or already enrolled, you’ve probably noticed something surprising:Original Medicare (Parts A & B) doesn’t cover everything. That’s where Medicare Supplement Insurance (also...

Medicare Supplement Plans in 2026: What’s Changing, What’s Not, and What It Means for You

If you’re on Medicare — or getting close — you’ve probably heard people talk about “Medicare Supplement” or “Medigap” plans. You’ve also probably heard…👉 “Plan letters”👉 “Original Medicare only covers 80%”👉 “Rates keep going up every year.” It’s a lot. So let’s walk...

Working Past 65? The New Rules of Medicare for Today’s “Unretired” Americans

If you’re turning 65, there’s a good chance you’re not retiring the way your parents did. Many of today’s 60-somethings are still working, consulting, starting businesses, helping with grandkids, or caring for aging parents. Life doesn’t magically slow down at 65—and...

Your Annual Medicare Checklist: What to Review Before You Change Plans

Choosing or changing your Medicare coverage isn’t something to rush. Each year, your health needs, prescriptions, and budget can shift—and plans change too. Use this simple checklist so you can feel confident in your decision. 1) Confirm your doctors and hospitals are...

7 Costly Medicare Mistakes (and How to Avoid Them)

1) Waiting too long to enroll If you miss your Initial Enrollment Period (the 7-month window around your 65th birthday) and don’t have qualifying employer coverage, you may face lifelong Part B and Part D penalties.Fix: Mark your IEP dates, or talk with an advisor 2–3...

“Snowbird Medicare: A Two-State Plan That Actually Works”

Snowbird Medicare: A Two-State Plan That Actually Works If you split the year between two homes, you already know about duplicate utility bills and the art of packing one jacket that somehow works in two climates. But there’s one thing snowbirds often overlook: how to...

Turning 65? The No-Stress Medicare Timeline (What to Do & When)

Medicare doesn’t have to be confusing. Use this simple month-by-month checklist to enroll on time, avoid penalties, and choose coverage that fits your doctors, prescriptions, travel, and budget. 6–9 Months Before Your 65th Birthday: Get Your Bearings Learn the basics:...

7 Smart Moves to Cut Health Costs and Get Better Coverage with Medicare (and the Right Insurance Pairings)

If you’re approaching 65, already on Medicare, or helping a parent navigate coverage, you’ve probably noticed two things: The rules change often, and 2) small choices can have big cost consequences. The good news? With a little structure—and the right partner—you can...

Financial Services

Insurance Services

Educational Blogs

Medicare

Financial Solutions Location

Tulsa, Oklahoma

Tulsa, Oklahoma

Contact Us: (918) 269-1919

Fax: (918) 610-8519

tayfinancialsolutions@gmail.com